June 16, 2014 – Recently ExxonMobil and Royal Dutch Shell both issued letters to their shareholders indicating that they were building a carbon tax into their revenue projections but saw no appreciable impact to in-ground assets from forthcoming climate change policies. Stranded assets has become a topic of importance to the fossil fuel sector because shareholders and major investment companies have started posing questions. The big one is, if we are to keep global warming to no more than an increase of 2 Celsius (3.6 Fahrenheit) degrees then how can we continue to take coal, oil and natural gas from the ground and burn it?

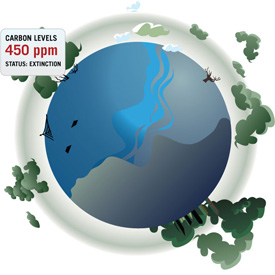

The magic number scientists believe we cannot cross is 450 parts per million (ppm) of CO2. That’s about a 50% increase in the amount of that greenhouse gas since 1950. Currently we are 400 ppm and inching upwards. The questioning by major shareholders and investors followed a 2011 report by Carbon Tracker, a not-for-profit based in the United Kingdom. Entitled “Unburnable Carbon – Are the world’s financial markets carrying a carbon bubble?” this document spelled out the amount of carbon we could continue to put into the atmosphere to remain under the 450 ppm CO2 level. At the time of the report, based on the amount that fossil fuel companies could still pump or mine it was determined that only 20% of existing reserves could be burned. Hence the term stranded assets was born.

In 2013 a second report, “Unburnable Carbon 2013: Wasted capital and stranded assets,” published by the same not-for-profit indicated that a carbon bubble was in the offing with $6 trillion US the number. This was the amount on the books of coal, gas and oil companies that could never be extracted and burned.

Since then stranded assets has moved to the forefront with a number of universities doing research papers and workshops on the subject. In May Carbon Tracker issued its third report, “Carbon Supply Cost Curves: Evaluating Financial Risk to Oil Capital Expenditures.” It looked a new capital expenditures on exploration, in particular, deep water oil, Arctic Ocean oil, and oil sands. These are areas of exploration where companies are expected to invest up to $13 trillion U.S. through 2050. The companies with greatest exposure include Petrobras, ExxonMobil, Rosneft and Royal Dutch Shell.

According to Carbon Tracker, in a world committed to action to not let CO2 atmospheric levels exceed 450 ppm, the industry would be facing a carbon bubble exceeding $28 trillion ($19.3 trillion for oil, $4 trillion for gas, $4.9 trillion for coal). The calculation is based on a floor price of $95 per barrel for oil and rising over the next several decades.

China, which has been gungho on coal-fired power plants, is not immune to the same issue. The latest report from Carbon Tracker, “The Great Coal Cap – China’s energy policies and the financial implications for thermal coal,” looks at stranded assets in coal-fired capacity. The U.S. Environmental Protection Agency (EPA) has also focused on coal in its latest regulatory policy focused on reducing emissions by 30% from 2005 levels by 2030. For China, so heavily invested in coal, it means stranded assets worth trillions. Energy utilities with an inventory of coal-fired power plants, and coal mining companies in the U.S. are equally at risk with stranded assets of greater value than those in China.

Carbon reduction policies are on a collision course with the financial reporting of fossil fuel and energy companies. That $28 trillion bubble, should it burst, will wipe out a large percentage of investors’ savings. And yet there has always been a way out for the fossil fuel and energy industry – diversification through investment in renewable energy including solar, storage, wind, tidal, wave and geothermal. Many of the fossil fuel giants have dabbled in the world of renewables but not to a point where they reduce their exploration budgets for carbon-based energy. Others in the fossil fuel community pay lip service to diversifying their mix of energy resources. BP is a great example having sold off its renewable energy investments.

Meanwhile, world leaders are being pressed by the overwhelming scientific evidence, and a growing majority of the public, to get serious about CO2, and when they do by bringing in hard targets, carbon trading and carbon taxes, what will ExxonMobil and Royal Dutch Shell do? According to their letters and disclosures to shareholders, it will be business as usual.

First 350 was the tipping point, now 450 is the target. If the temperatures continue to not increase what would they then conclude?- Negative climate change? It gets more ludicrous by the decade.

Thanks for helping spread this important financial news. It is so important for freeing up the billions in capital necessary for investment in renewables and their byproducts like this development which holds promise: https://www.21stcentech.com/limiting-co2-450-parts-million-impact-fossil-fuel-companies/