January 5, 2015 – Taxing carbon has been seen as a bad idea by business and financial conservatives for a long time. But it seems with the Paris global climate agreement on the agenda this year that opposition to carbon taxes is waning.

In Canada back in 2008, a federal election was fought with a carbon tax proposed by one of the main political parties. The party that won, the Conservatives, described a carbon tax as an imposition that would “screw everybody.” And in the post-election debacle, the leaders of those who lost described this early attempt at a “green shift” as a vote loser.

Seven years later the history of jurisdictions imposing carbon taxes seems spotty indeed.

- Finland was the first country to institute a carbon tax in 1990. The current tax is 18.05 Euros per ton of CO2. It currently is a combined carbon and energy tax. Today Finland’s emission rates are 6% below the target set by the European Union of 20% reductions from 1990 by 2020. In fact the country is on course to reduce emissions 80% below 1990 levels by 2050.

- Sweden followed Finland with a carbon tax a year later. Its current level of tax is $150 USD per ton of CO2 but the tax is not applied to fuels used to generate electricity, and industries pay only 50% of the tax. Fuels from renewable sources are exempted which has encouraged the rise in the use of biomass for heating in homes and industry. Since implementation Sweden has reduced its carbon emissions at an annual rate of 0.5%. CO2 emission reductions of 40% are projected by 2020 and zero net emissions by 2050.

- The United Kingdom introduced a climate change tax in 2001. It was described as a levy charged on gasoline, diesel, and other oil products used in industry and the public sector. Recently there is talk of changing the tax from climate change to a carbon levy with a focus on the carbon content of fuels.

- Boulder, a city in Colorado, was the first jurisdiction in the United States to introduce a carbon tax in 2007. The initial tax at $7 USD per ton of carbon cost the average household about $1.33 USD per month. Households that installed renewable energy received discounts. The tax has become a progressive one with rates rising to $12 and $13 USD since implementation.

- Quebec introduced a carbon tax in 2007 but at such a miniscule amount ($0.08 CDN) per liter of petroleum product produced by oil companies operating in the province. The tax has had no impact on consumption or on emission reductions.

- British Columbia, Canada’s most western province implemented a revenue neutral progressive carbon tax in 2008 beginning with $10 CDN and rising to $30 per metric ton of carbon dioxide (CO2). Levies on fuel are offset by reductions in personal and business taxes. It has been an unqualified success leading to CO2 reductions and economic growth within the province.

- Ireland has levied a variable carbon tax since 2010 on vehicle purchases based on emission levels, on fossil fuels used to heat homes, farms, offices and industry, and even on curbside trash. Emissions have declined by 15% since 2008 which may have more to do with the Irish recession than with the tax acting as an inhibitor to burning carbon.

- Australia introduced a progressive carbon tax that started at $23.00 AUD in 2012 and was to increase to over $25 by 2014, but after two years and an election, its new government repealed the tax. Now the country is doing cap-and-trade on carbon with countries in Asia.

- Chile has recently introduced a $5 USD carbon tax on CO2 but it is restricted to 55% of the nation’s carbon emitters and doesn’t take effect until 2018. So this first effort in South America is far from implementation. And when you consider the recent Lima climate talks, points to an amazing lack of progress on that continent.

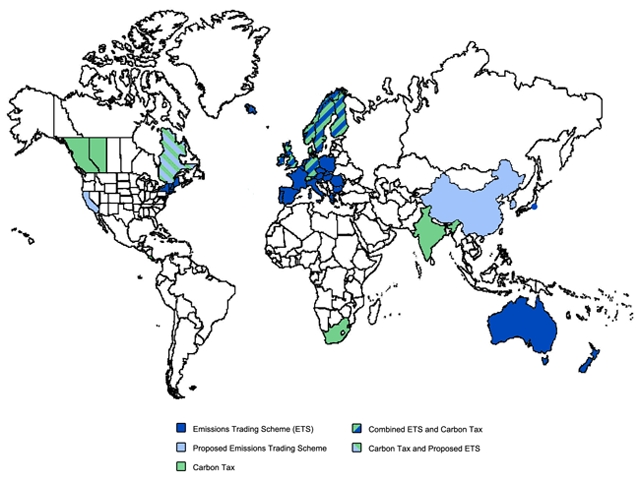

The above doesn’t include countries contemplating the introduction of a carbon tax and as of yet have failed to pass appropriate legislation. Nor does it include countries that are partners in the cap-and-trade emissions trading scheme to which the European Union belongs. For an up-to-date reference check the map below on who’s who in the carbon tax, levy and emissions trading world.

What is most striking is how few are the countries with any color. That’s why the column appearing in yesterday’s Financial Times by Lawrence Summers, entitled, “Let this be the year when we put a proper price on carbon” is all the more interesting. Here is a big business paper calling for nations to introduce carbon taxes. Does this mean we are about to see the map fill with color? One may think so when the Financial Times and other business papers like The Globe and Mail and The Wall Street Journal all start editorializing about implementing carbon taxes.

In his Financial Times column Summers argues “that which is not paid for is overused.” He argues that the economy would “function better by levying carbon taxes and rebating the revenues to society.” This is consistent with the messages being written in other business publication.

Summers points to the decline in energy prices as a crisis in waiting which could “exacerbate the problem of energy overuse” And lead to greater carbon emissions. Note the recent increase in sales of big SUVs in the United States which correlates directly with falling prices at the gas pumps.

So the timing appears right to propose a reasonable starting carbon tax of $25 USD per ton of CO2. In one year such a U.S. tax would raise over $100 billion USD. Summers thinks the money should be used in part, about half, to fund needed infrastructure projects, while the rest should be rebated to industry and consumers through tax credits. This is very much in line with the British Columbia model which has been described in glowing terms by business as “an environmental and economic success.”

In his concluding remarks, Summers states: “Conservatives who believe in the power of markets should favor carbon taxes on market principles. And Americans who want to see their country lead on the energy and climate issues that are crucial to the world this century should want to be in the vanguard on carbon taxes. Now is the time.”

Substitute the word “Americans” with that of any other nationality and it sums up what needs to happen in 2015 everywhere.

[…] Originally published by 21stcentech.com. […]

[…] generated by such demand are just one of the financial benefits of an eco-friendly business. Governments in both the U.S. and the U.K. are working to provide subsidies, including grant […]