Royal Dutch Shell, Chevron Canada and Marathon Oil, with massive subsidies from the Canadian federal and Alberta provincial governments announced on September 5, 2012 that they are proceeding with Quest, the first carbon capture and storage facility associated with Western Canadian oil sands operations. This announcement comes a few months after other major players, including TransAlta, abandoned a sequestration project stating the economics made no sense.

Why is carbon capture and sequestration (CCS) such an economic boondoggle? Because the real cost gets buried in subsidies. The project will receive over 10 years almost $900 million from the two governments. The partners, in addition, will be able to sell the carbon credits they earn for each ton of sequestered CO2. What are those carbon credits worth? $15 per ton with a further double credit on every ton offered by the Alberta government and hints that carbon credits may be worth even more in the near future. That means the 1 million tons Quest will bury each year will return minimally$30 million to its operators every year. The total cost of the project build is estimated at $485 million with a ten-year operational budget including building costs of $1.35 billion.

So do the math.

Ten years of CCS yields +$300 million in carbon credits (at $30 per ton, 300% higher than current European carbon capture exchange rates)

Government subsidies amount to $865 million (using tax money to encourage the industry to make the commitment to CCS).

Operational and construction costs equal $1.35 billion over 10 years.

Cost to the industry over a decade all in after factoring in subsidies and earned credits, $155 million.

So profiting from CCS may equate.

On the other hand will the 10 million tons of CO2 sequestered reduce overall carbon emissions from oil sands projects? No, since new production volume forecasts indicated carbon emissions would grow by 226% from 2005 to 2020.

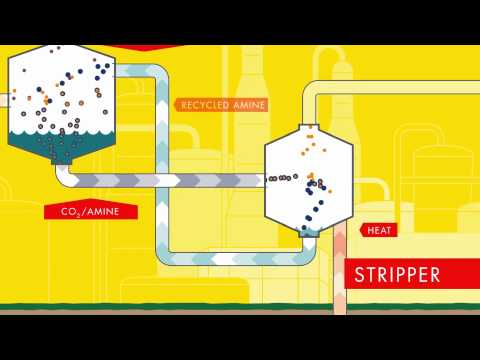

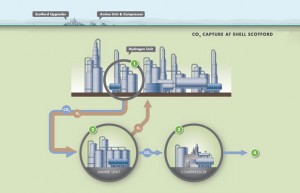

What’s involved in this CCS project? A large reservoir of sandstone 2,000 to 2,500 meters (6,500 – 8,000 feet) below the surface at a site 90 kilometers (55 miles) north of the oil sands production facility. Using a technology developed by Shell in the Netherlands for stripping carbon from production outflow gases, the CO2 will be liquefied and transported by pipeline to the injection site where three test wells have been drilled to ensure the viability of the subsurface rock formation. The site should be operational by 2015.

The net benefit to the operators is a reduction in carbon footprint for every barrel of synthetic crude of 15% and an overall carbon reduction impact on all oil sands emissions of 2.2%.

Royal Dutch Shell is the majority owner, designer, builder and operator of Quest and describes the project as core to its CCS research which it then hopes to turn into a commercial business opportunity.