April 18, 2017 – What if you are about to make a $1,000 purchase and put it on your credit card and an accompanying mobile app on your smartphone says “no?” That’s what banks and credit card issuers are experimenting with now to help consumers make financial decisions that don’t stretch their capacity to pay the bills.

In a recent article by Ben McLannahan, Financial Post, he describes how big banks are experimenting with digital financial assistant bots. These smartphone apps track all of your financial assets and liabilities and are proactive in giving advice.

What’s out there? McLannahan talks of two offered by banks including

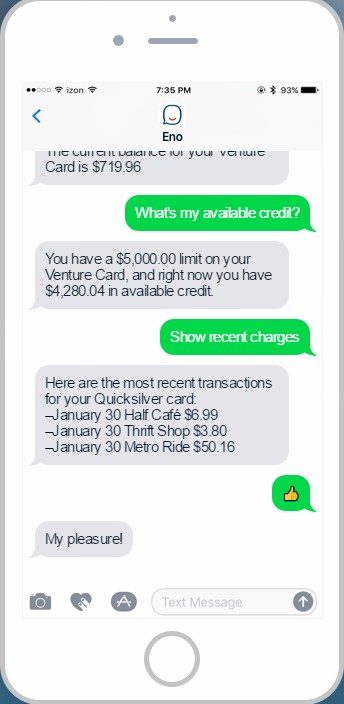

- Eno from Capital One – a gender neutral chatbot that communicates by text message to help consumers when making purchases. It even understands emojis like a bag of money or a thumbs up.

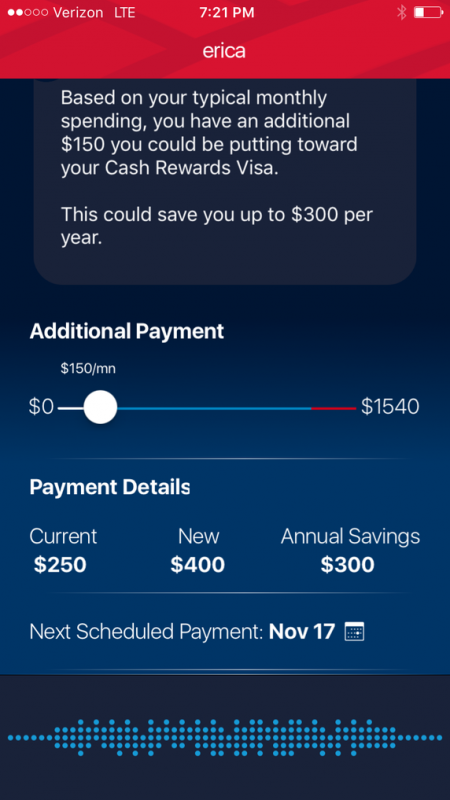

- Erica from Bank of America – a virtual assistant that uses text and talk to help consumers make better financial decisions.

Although many banks have developed online banking and now smartphone apps to give consumers access to all kinds of financial transactions, the use of artificial intelligence (AI) to enhance customer relationships beyond answering rote questions, opening an account or paying bills, represents a significant breakthrough. When an app can tell you that you may be making a mistake in an impulse buying decision at the point of sale, showing you that spending the money is an unwarranted risk, it could mean thousands of dollars saved annually. It is truly an early warning system, a conscience on the shoulder, to keep consumers from falling into unmanageable debt. And that means for the banks cost savings with less bad debt exposure.

For the banks, it is another step into automation that reduces face time between bank employees and customers. Starting with automated tellers that date back to 1969, and online banking beginning in 1983 even before the Internet, financial institutions have been embracing automation at a steady clip. Because they are banks they have been cautious in adopting these technologies.

When independent fintech app developers arrived on the scene in conjunction with the explosive growth of smartphones, the banks were largely caught flatfooted. They are now catching up embracing the use of chatbots and virtual assistants, voice recognition, and AI. In a recent press release from Bank of America, on the subject of mobile banking enhancements, it states, “we recognize that for each individual, gaining control over their financial lives and making finances simpler and easier to manage means something different, and we are committed to providing customers the tailored solutions they want to make their financial lives better.”

It is likely through widespread fintech apps we will see fully synchronized text and voice banking, payments, commerce become the primary way consumers will interact with where they keep their money within this decade. This is in lockstep with the rise of the millennial generation who have demonstrated a preference for apps and bots and smartphones, and appear to value personalization without a lot of human contact. At least that’s the way it seems when you ride on a subway train and watch 70 to 80% of the passengers looking at their smartphone screens.

If your bank isn’t offering its own AI bot you can find apps that will give you an opportunity to experience the future now. Here are three:

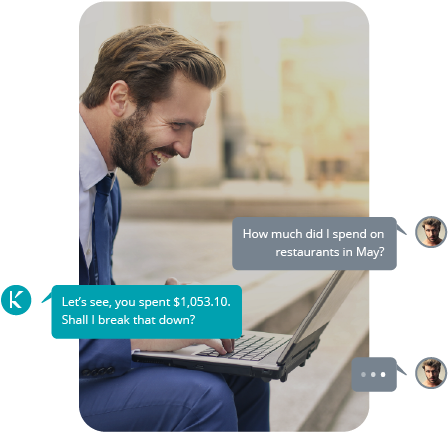

- MyKAI (seen in the image below) provides U.S. users with a smartphone personal banker that interacts with you through standard text and messaging services

- Trim – a personal financial smartphone app assistant that eliminates recurring charges consumers may have forgotten about.

- Clarity Money – which describes itself as having your financial back by canceling wasteful accounts, getting you better deals and doing it all for free.