October 8, 2019 – When you think about most governments around the world today you usually associate them with seeking to provide for their citizens in positive ways. But the truth is that has not been the case when it comes to “sin taxes” as a government source of revenue.

What are sin taxes?

Think about products that are harmful to consumers but a valuable source of government revenue. We are talking about tobacco, and alcohol.

Even legalized gambling falls under this definition as does the sex trade and pornography.

And today you can add fossil fuels to the mix when you consider how much governments earn in royalties from every ton of coal, barrel of oil or cubic meter of natural gas extracted and delivered to consumers. The carbon dioxide (CO2) and methane (CH4) these fuels produce are the cause of atmospheric warming on an unprecedented scale and all of us on the planet are victims.

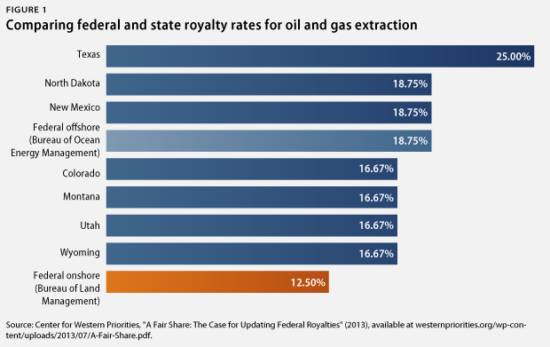

Most sin taxes come in the form of duty, excise charges, or royalties. In 2015, duty and excise taxes contributed $98.3 billion to the U.S. treasury amounting to 3% of total government revenue. In that same year, federal and state royalties from oil and gas companies were collected at variable rates as seen in the graph below. How much does the federal U.S. government collect from fossil fuel companies operating on federal lands? In 2010 when oil prices were high it amounted to $14 billion annually. In 2016 the number sunk to $6 billion.

In Canada in 2016-17, sin taxes raised $28 billion. Alcohol’s contribution totaled $11.9 billion, tobacco $8.3 billion, and gambling $7.5 billion. Alberta, home to most of Canada’s oil sands has earned revenue from royalties at every phase of development of this resource from pre-payout royalties, to production, and byproduct royalties. Because oil and gas are commodities their prices are set by the market. This has contributed to boom and bust cycles in Alberta. In 2015, Alberta collected $1.4 billion from fossil fuel companies. In 2016 when prices fell, royalty revenue dropped to $827 million.

The Government Conundrum

No government wants to foreswear large sources of income. But the problem is, the money earned from products and industries that are harmful to the public labels them as merchants of death.

What makes things even worse is that governments often subsidize these products such as Canadian and U.S. tobacco handouts to growers, and tax deferment and other incentives to oil and natural gas project developers. It may make sense to subsidize an industry that is contributing revenue to government coffers. But it’s the coffins that concern me, not the coffers. Our governments cannot continue to earn money while delivering death, disease, addiction, and environmental degradation. It is immoral.

Just how so? Let’s look at the hidden costs of these three products.

Smoking Tobacco – Product #1 That Kills While Contributing to Government Revenue

According to the Centers for Disease Control and Prevention (CDC), tobacco is the single largest cause of preventable death and disease in the United States killing more than 480,000 Americans annually. The cost of smoking-related illnesses equals $300 billion annually.

The Canadian Cancer Society reports 45,000 preventable deaths from tobacco in Canada annually, and in 2012, $6.5 billion in direct health care costs and $16.2 billion in total economic losses.

Drinking Alcohol – Product #2 That Kills While Contributing to Government Revenue

The CDC reports that 6 people daily dies in the United States from alcohol poisoning. The number of Americans who are binge drinkers exceeds 30 million. Alcohol abuse and excess drinking is leading to 88,000 American deaths annually. That’s twice the number of deaths from prescription opioids and heroin. Alcohol leads to drunk-driving deaths, contributes to liver disease, strokes, diabetes, heart disease and more.

The CDC reports that alcohol is responsible for one-in-ten deaths in working-age Americans and the economic costs equaled $249 billion in 2010.

In Canada, data from 2002 reports more than 4,200 deaths annually from alcohol abuse. In 2008 alcohol was considered the leading cause of criminal death from impaired driving. In 2011, among psychoactive drugs, alcohol was listed as the number one cause for hospitalizations.

The Canadian Centre on Substance Use and Addiction and the Canadian Institute for Substance Use Research, in a recent report, estimated alcohol abuse was costing Canadians $15 billion annually in lost productivity, justice costs, disease, and more.

A 2015 report noted that 3.1 million Canadians were at risk from alcohol consumption and 4.4 million at risk for chronic health effects.

Burning Fossil Fuels – Product #3 Contributing to Government Revenue while Causing Killing Climate Change

Both product #1 and #2 are the original compromise governments made with citizens in providing them with legally supplied products that contribute to death. But fossil fuels are on an entirely different scale. Why is that?

Fossil fuels are embedded in our economic existence. Without them, our world economy would be crippled considerably.

When we began extracting them centuries ago it was clearly seen by humanity to be a net benefit. Certainly for the government, the sale of leases and the revenue earned for every unit of extraction were attractive incentives to support the industry. Almost every jurisdiction on the planet which had access to oil and natural gas resources became addicted to the income derived from these products.

In 2016, the Union of Concerned Scientists published an essay entitled “The Hidden Costs of Fossil Fuels.” It described the externalities in terms of cost for the extraction, transportation, burning, and disposal of fossil fuels.

It noted that the extraction process was responsible for significant air and water pollution.

Transportation was an equal contributor to air pollution with spills threatening water and land sources.

And when the fuels were burned they too added pollutants, and toxins to the air, and as we know today, contributed to the global warming that is becoming far too evident.

Even the waste disposal of fossil fuels was seen as a hazard to public health and the environment.

The air pollution from burning fossil fuels contributed to acid rain, asthma, and respiratory diseases.

In the U.S., fossil fuel-generated aerosols in 2010, it noted, contributed to 13,200 deaths, 9,700 hospitalizations, and 20,000 heart attacks.

Mercury entering freshwater resources from coal-fired power plants was associated with a growing number of neurological and neurobehavioral changes in young people.

In one 2005 study the annual health costs from the burning of fossil fuels were estimated to be $62 billion. Another study put that number far higher, at $187 billion.

Governments Need a Reset on Sin Taxes

Governments shouldn’t be merchants of death. If our collective goal as a species is to save ourselves while saving the planet, then it is pretty clear governments have to look at the industries they support because of the revenue they generate.

Human society cannot continue to inflict upon itself products and practices that will ultimately do great harm to our species and the biodiversity on our planet.

Can we end the addictions?

Time will tell.

Do we need to?

In all three products described above, the answer is an unequivocal yes.

Will we?

That’s something each of us can do something about in speaking and demonstrating to those who govern us, armed with the type of facts described here.