October 27, 2013 – A letter sent to the Chairman, CFO and Chief Executive of BP on September 9, 2013, is one among 45 sent to fossil fuel energy companies by a group of 70 high-powered investors representing $3 trillion in investments in these companies The authors include managers, CFOs, treasurers and CEOs from large pension funds, foundations, mutual funds, U.S., U.K. and Australian government officials, and other asset managers.

In the letter it states, “we would like to understand BP’s reserve exposure to the risks associated with current and probable future policies for reducing GHG emissions by 80% by 2050 to achieve the 2 degrees Celsius goal, and the risks to its operations as well as the economy as a whole of increasing extreme weather associated with the world’s current path to a warming of 3.6 degrees Celsius or more. We would also like to understand what options there are for BP to manage these risks by, for example, reducing the carbon intensity of its assets, divesting its most carbon-intensive assets, diversifying its business by investing in lower-carbon energy sources, or returning capital to shareholders.”

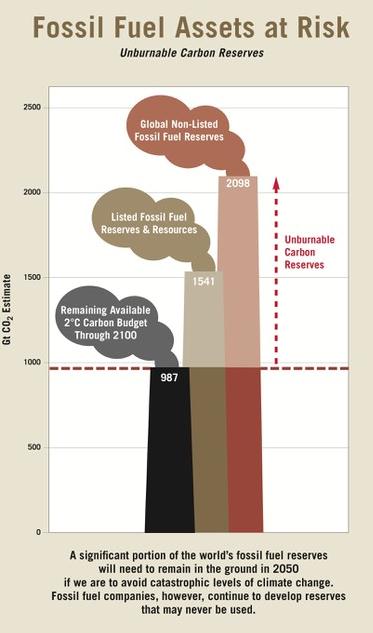

In addition the letter states, “Under a carbon-constrained scenario….40 to 60% of their market value could be lost because a portion of their proven reserves would become stranded assets.” It further questions the “creditworthiness of oil and gas companies, particularly those that have large exposure to high cost unconventional oil and production such as oil sands.”

The letter goes on to ask BP to review and disclose its risk assessment plans pointing out that BP’s “business-as-usual scenario such as that used in….current reporting” appears to be seriously flawed. The signators asked that this re-assessment evaluate “potential GHG emissions associated with the production of all unproduced reserves.”

This is an unprecedented request by investors who are asking not just BP but 44 other fossil fuel energy companies to come clean about their futures in light of the latest IPCC report on climate change. It’s no wonder that companies like Exxon fund disinformation campaigns like the one recently launched by the Heartland Institute in anticipation of the release of the IPCC interim report.

What these 70 investors are stating for the first time is that fossil fuel companies need to come clean about climate change and how they intend to address it. These investors are questioning the value of “unburnable” carbon reserves currently considered assets on fossil fuel company books. If these fossil fuel assets are unburnable then all the fossil fuel companies need to adjust their books to reflect real value, or they must diversify into non-carbon energy technologies or other businesses to retain the confidence of the shareholders these investors represent. But BP has been demonstrating the exact opposite strategy in some of their most recent moves.

For example, in 2011 BP divested itself of its solar business stating “the continuing global economic challenges have significantly impacted the solar industry, making it difficult to sustain long-term returns for the company.” In 2012 the company got out of the wind power business stating the move as “a continuing effort to become a more focused oil and gas company and re-position the company for sustainable growth into the future.” I wonder if the writers of the letter of September 9 saw these BP executive statements before composing their missive to the company and other fossil fuel giants?