September 1, 2016 – It began with California and then Quebec, then Ontario, and now Mexico. An agreement to work on a common carbon market to reduce greenhouse gas emissions is expanding to include more and more North American jurisdictions. And although California is not mentioned in yesterday’s announcement, Mexico through its collaboration with the two Canadian provinces will inevitably get involved with the U.S. state (wall built or not).

How will it work?

The two provinces will be able to buy Mexican carbon credits and sell them to industries operating within their jurisdictions. Similarly Mexico will be able to purchase credits from the Canadian provinces to sell to the industries in its market. The revenue earned from the credits will be used by each jurisdiction differently. In the case of Quebec and Ontario, the focus is on funding green projects within the provinces. Mexico may choose to use the revenue similarly.

That certainly is the case in California based on a separate announcement yesterday. California legislature and governor agreed to put over $900 million collected through cap-and-trade into green projects focused on reducing emissions. The state so far has raised more than $1.4 billion in its carbon market but only two-thirds has yet been assigned to projects which include:

- subsidies for electric vehicles (EVs)

- investments in urban transit and green spaces

- energy efficiency upgrades to aging buildings

- affordable housing projects in low-income communities

Cap-and-trade is being tried in other countries as well. It was instituted as part of the European Union’s Emissions Trading Wcheme in 2005. China announced a regional and urban cap-and-trade pilot program in 2013 starting with the city of Shenzhen. In 2015 China added the cities of Beijing, Tianjin, Shanghai, and Chongqing as well as the provinces of Guangdong and Hubei. The next step will be a national rollout beginning in 2017.

Ontario’s program takes effect on January 1, 2017.

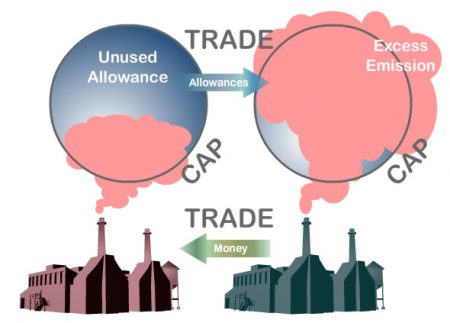

If you are unfamiliar with how cap-and-trade works, it is a market driven scheme to reduce emissions and begins with a cap set on emissions. The cap is then lowered over time. The trade portion includes allocated carbon allowances which companies must meet within the cap. If they don’t they pay for credits to cover the excess emissions. Companies that are efficient in reducing emissions under their allocated allowance can sell the difference to companies that don’t meet theirs. First tried in the late 1980s in North America and eventually globally as a means to use market mechanisms to combat ozone depletion through emission reductions of chlorofluorocarbons, its application to greenhouse gases seems to be working already in Europe and California.

Not everyone is sold on cap-and-trade as a mechanism for combating greenhouse gas emissions and climate change. George Soros, the billionaire, in 2007 stated, “The cap-and-trade system of emissions trading is very difficult to control and its effects are diluted…It is precisely because I am a market practitioner that I know the flaws in the system.” Others describe it as a stealth approach to combating climate change rather than tackling it head on. Companies with deep pockets can purchase offset credits and continue to produce carbon pollution with impunity while passing the costs on to their customers.