July 31, 2018 – Blockchain has been heralded as the answer to what ails everything these days. Want to solve banking issues? Use the blockchain. Want to solve supply chain issues? Again, the blockchain. The same goes for law, healthcare, international shipping, government, communications, and even climate change.

Can the blockchain be the universal panacea? How can one technology satisfy so many different requirements?

Perhaps if we better understood what the blockchain technology is, we could begin to see its real worth.

A blockchain is a digital technology designed to manage a data record independent of a central authority. It is a product of the web and cloud computing. It is described as being a method of decentralized bookkeeping.

With a blockchain, it doesn’t matter what is the nature of the transaction but only the content within it. It is business neutral.

Every blockchain transaction contains the following:

- A protocol that ensures parties to a single transaction all agree on the content and validated value of it.

- A public record of the transaction or “block” recorded to a distributed ledger maintained across the web and not at any single locale, and therefore, accessible to all with permission to see the information.

- A secure contract in the form of software code that cannot be altered without all parties to the “block” noticing it.

As a distributed ledger containing blocks shared across public and private computing networks, the data of each block is contained in a copy on every computer node within these networks. There is no single point of failure. And because every block is encrypted, and any new blocks added to a chain must go through a validating protocol shared by all who are participants in the transaction, no single entity can pull a fast one preventing fraud, double accounting or identity theft.

Sounds like a foolproof solution for all the world to use doesn’t it?

But there are caveats. The blockchain technology, in operating in an open environment with no single point of centralized trust, can be vulnerable to those operators on the web who have malicious intent. That’s why the creators of the blockchain technology have, within the commonly accepted protocol have added an extra component called “proof of work” which is described as a computationally expensive validation for each “block” entry involving significant computer horsepower.

This “proof of work” validation differentiates the blockchain from centralized transaction processing in a significant way because it is a drag on transaction speed. Blockchain transactions don’t happen at the speed of light. Instead of an exchange running millions of trades per second on a centralized system, the best a blockchain can do to-date is run several hundred without adding significant computer horsepower. Overcome the feeds and speeds issue and the blockchain could become the secure public ledger of the Internet for any type of transaction. But we are a long way from that.

At a recent World Economic Forum conference in Davos, Switzerland, those attending were surveyed about the future impact of the blockchain. The conclusion of the attendees was that 10% of global GDP would be stored on blockchain technology by 2027.

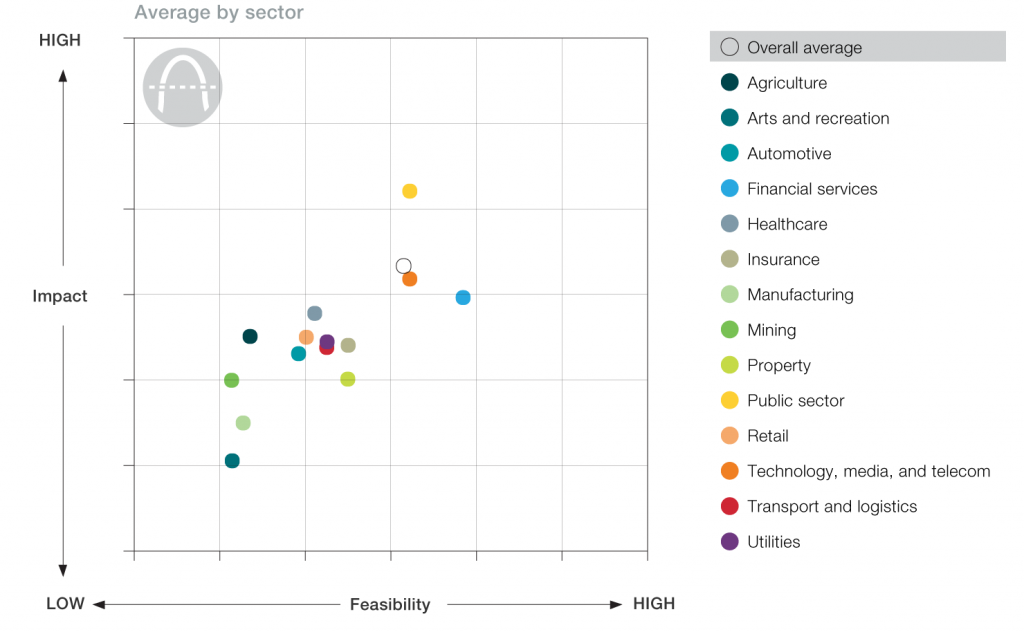

McKinsey & Company, a prominent management consulting firm, describes the blockchain as an “immature technology” for which a “clear recipe for success…has not yet emerged.” In McKinsey’s analysis, it has discovered more than 90 uses of the technology in varying states of maturity across a number of industries. The graph displayed below comes from McKinsey.

By economic sector the use of the blockchain breaks down as follows:

- Agriculture – food safety and origin, managing agricultural supply chains, cannabis supply chain for medical quality control and a supply chain registry to eliminate black-market products getting into the public domain, and managing food vouchers for refugee and drought relief programs.

- Arts and recreation – investment and provenance of fine art, and gambling transactions including odds management and payout systems.

- Automotive – accumulating autonomous-vehicle data, managing electric vehicles and charging, vehicle registries, tracking car parts, leasing and car payments

- Financial services – financing trade and supply chains, cross-border business-to-business and personal payment systems, loan applications and delivery, registering collateral, initial coin offerings, money laundering detection, invoicing and dispute resolution, private equity investments, microloans and payments, stock and commodity trades, and financial inclusion of people in the Developing World who have no bank accounts.

- Healthcare – research data and results including tracking of clinical trials, patient identity and security, electronic health records, medical payments, drug supply chain, and health insurance.

- Insurance – claims management, security and identity management, reinsurance, and fraud detection.

- Manufacturing -supply chain management.

- Mining – product provenance, material asset management, and supply chain management.

- Property – land registry, property search, title exchange, leasing, and fractional investment.

- Public sector – e-voting, welfare payments, cybersecurity, infrastructure security, tax reporting and collection, civil registry, international aid, budget and government spending, patents, public procurement, and incorporation services.

- Retail – point-of-sale acquisition, product verification, decentralized sales and marketing, and loyalty programs.

- Technology, media, and telecom – data management services, digital content licensing, cloud storage of company data, roaming fraud prevention, digital identity management, Internet of Things application management, spectrum sharing, subscriber authentication, blockchain as a service, 5G enablement, integrated billing and provisioning.

- Transport and logistics – shipping, identity management of transit assets, aircraft maintenance, ticket distribution, and airline miles programs.

- Utilities – renewable energy certificates, energy leasing, wholesale energy trading, Internet of Things utility management, carbon credits, smart-home meters, electric vehicle charging, person-to-person microgrid transactions, and distributed energy systems management.

McKinsey rates the blockchain as an up and comer still three to five years away from scaling up to be considered as a replacement for centralized bookkeeping across the industries mentioned above.

At some point will we see the blockchain regulated?

For the moment, the most common use of the blockchain is transacting cryptocurrencies such as Bitcoin. To date, no jurisdiction has attempted to implement a full regulatory framework. Bitcoins and other cryptocurrencies traded using the blockchain still represent a fraction of the global financial market, and until they grow in stature will remain outside the purview of most government regulators. So it remains a bit of a Wild West and we have witnessed over the last year just how volatile are the results.