On a blog site devoted to looking at technology and science advancements in the 21st century, why should I be writing about my and your long-term investment strategies? Well let me tell you. We are at a moment in time when we need to look at energy stocks and their future viability. Traditionally these stocks have been top performers for earnings and dividends. But the world of fossil fuels is waking up to a new reality. All those proven reserves may be worth nothing if political leadership puts a plug in the well.

In an article published in Forbes last December, entitled Fossil Fuel Divestment Is A Timely Issue For Investors, the author talks about a climate cliff, a point in time when our continuous harvesting and burning of carbon-based fuels tips us into a new age of economic and social disruption caused by wonky weather, rising sea levels and biological extinction for many species on the planet.

From purely an investment point of view, therefore, it would seem that oil companies represent a bad long-term investment. Yet today they provide some of the best return on investment for stockholders. I’m one of those stockholders and I find myself in a quandary. My investment advisors who have created my balanced portfolio have populated it with a mix of energy producers. But for how much longer? And should I be insisting that my wife and I revise our portfolio to divest ourselves of fossil fuel energy producers?

Every time an oil company drills a new fracking well or discovers a new gas or oil deposit in the deep sea they revise their proven and estimated reserves. And those numbers affect share prices. But here is the conundrum. Finding more oil and gas may prove meaningless in light of rising CO2 levels in the atmosphere. The oil and gas discoveries may prove, in light of global warming, to have no value whatsoever because we will never be able to use them. Leaving them in the ground may be our sole strategy for minimizing the disruption that will come from rising atmospheric temperatures.

If you want to get a better understanding of the problem read Unburnable Carbon 2013: Wasted capital and stranded assets, a report from the Grantham Research Institute at the London School of Economics and Political Science. It concludes:

- If we burn current reserves on company books the CO2 we emit will alter the world in which we live so dramatically it will redefine nations and civilization.

- Current energy companies continue to waste money finding and developing new oil, natural gas and coal reserves spending tens of billions annually in finding them.

- All energy companies are overvalued because their current proven fossil fuel reserves cannot be burned if we are to minimize the impact of CO2 for the foreseeable future keeping levels to 450 ppm and no higher.

- Carbon capture and sequestration (CCS) technology can only marginally mitigate the impact of burning fossil fuels, an estimated 12 to 14%, and therefore the technology largely represents a fool’s errand.

This year I reported that CO2 levels had reached a milestone 400 ppm in readings from Mauna Loa, the volcano on the main island of Hawaii. That represents a 25% rise in CO2 since 1955. More frightening is the fact that CO2 level increases are accelerating with much of the increase happening in the last two decades, correlating to an overall rise in atmospheric and ocean surface temperatures that seem to be keeping pace. And CO2 isn’t the only greenhouse gas on the rise. Methane, an even more potent gas, is being released at fracking wellheads, and through polar permafrost melts in the high Arctic.

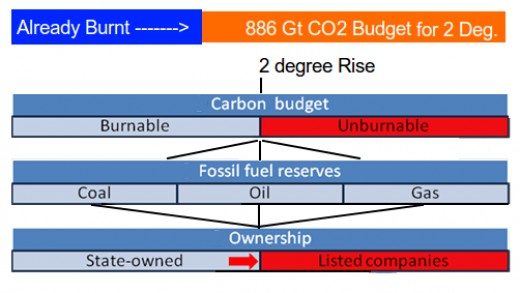

The Grantham report paints a very good picture for investors in fossil fuels. If we limit what we burn so that we keep global temperatures from rising beyond the 1.5 to 2 Celsius (2.7 to 3.8 Fahrenheit) degrees then we cannot burn a good portion of what exists in reserves today.

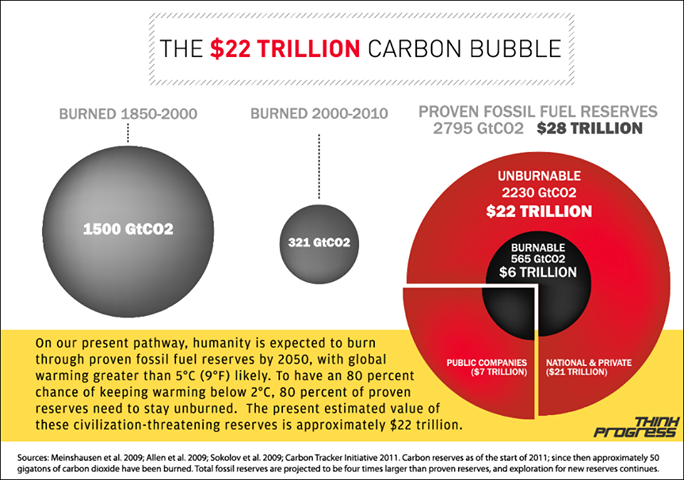

Total proven reserves today if burnt equal 2,860 Gigatons of CO2. Burn all of this and scientists tell us that we will raise the average temperature of the atmosphere by over 3 Celsius (5.4 Fahrenheit) degrees. At the poles where we are seeing temperatures rising by 5 or more Celsius (9 Fahrenheit) today when average atmospheric temperatures have only increased by less than 1 degree Celsius (1.8 Fahrenheit), we could see increases in the double digits. That means the end of permanent polar sea ice and increasing sea levels.

So let’s say we only burn half the current reserves and leave the rest in the ground. Maybe then we can keep global temperatures within the 2 Celsius (3.8 Fahrenheit) target limit. So what then is the real value of all this drilling and finding of new oil and gas when so much of what has been discovered can never be burned? And I do mean never. We cannot afford to put any of this CO2 into the atmosphere after 2050 because the gas already in the atmosphere will linger for as much as several millennia unless we discover new CCS technologies that really make a difference in sucking the stuff out of the atmosphere at a faster rate than natural processes.

One thing is very clear.

Oil, gas and coal companies are clearly overvalued, that is, if we are serious about tackling CO2 and climate change. Otherwise the continued positive performance in share price of these energy providers speaks to a total lack of understanding by the companies, our governments, and us, about what we face.

In an article appearing in the July-August issue of Report on Business Magazine, Eric Reguly states “the more serious threat to oil or coal investors is an environmental Pearl Harbor — a global warming catastrophe so damaging that carbon output would have to be slashed in a hurry.” Call it Pearl Harbor or Armageddon, it appears that without global action we are headed in that direction.

But many of the energy providers are very cognizant of the shifting sands of their perceived value if not the moral and survival issue of tackling CO2 emissions. These companies are investing in clean energy enterprises. For example, in today’s Globe and Mail newspaper, an article appears about TransCanada, the developer of Keystone XL, (that as yet built oil sands pipeline venture), taking possession of the first of nine Ontario-based solar power facilities. These nine will generate 86 Megawatts once online, enough energy to power 17,000 homes. This is part of TransCanada’s carbon-free portfolio, a hedge maybe against its existing carbon assets. Maybe TransCanada knows something about the latter’s real net worth. I wonder how many other oil companies are hedging their bets as well, or will they, along with the investment community suddenly have a rude awakening?

When my wife and I next meet with our investment advisers later in the summer I have a question for them. What will be their and our divestment strategy related to energy companies? What is yours after you have read this posting?