July 23, 2014 – Climate change is threatening the credit rating of nations. Standard & Poor’s (S&P) has indicated that the credit ratings of 128 nations are at risk. S&P sees climate change as a more challenging problem than the changing demographics of our human population from aging in the Developed World to surging population in Developing Nations.

- Where we can plot the demographic changes to our human population the outcomes of climate change remain big unknowns. The climate studies and projections cover a wide range of possibilities from the levels oceans will rise to just how warm the atmosphere will get and how that will impact precipitation patterns.

- The lack of agreement on implementing collective action by governments around the world creates uncertainty.

- Any action on climate change will have a disproportionate impact on the least developed and poorest nations, lacking the infrastructure and financial means to implement mitigation strategies. This is resented by Developing Nations who blame the Developed World for our present CO2 atmospheric levels and what climate impacts will result from this increased carbon.

S&P attempts to isolate those factors in climate change that are of greatest threat to a nations’ present and future credit rating. These include:

- Extreme weather events are trending upward since the 1980s. Reinsurers have documented weather-related events and economic losses resulting from them and note a fourfold rise in the number and a fivefold increase in cost. Most affected – Asia and North American countries.

- Changing patterns of rainfall, prolonged droughts, heat waves, wildfires, floods and rising sea levels are impacting economic growth of nations. This impacts crop yields, infrastructure, productivity and government as incomes and tax revenue declines. Gross Domestic Product (GDP) growth is the measure by which S&P evaluates nation and based on current baseline climate change scenarios it is projected that by 2100 overall GDP decline will be between 2 and 5% annually.

- Negative GDP will most impact poorer nations who already collect less tax revenue per citizen than those nations of the Developed World. In all nations exports will be impacted as productivity declines. But in Developing nations, suffering from both the stress of population growth and declining agricultural yields, S&P believes we will see net food imports increase leading to growing trade imbalances and depreciation of national currencies.

How has S&P compiled their rating table? They are using data from the World Bank, the Food and Agriculture Organization of the United Nations (FAO-UN) and Notre Dame University’s Global Adaptation Index (ND-GAIN). World Bank data includes information on populations at risk to rising sea levels. FAO-UN data measures agricultural output as a share of GDP and the risk to that sector. ND-GAIN measures a nation’s exposure, sensitivity and adaptive capacity to climate change.

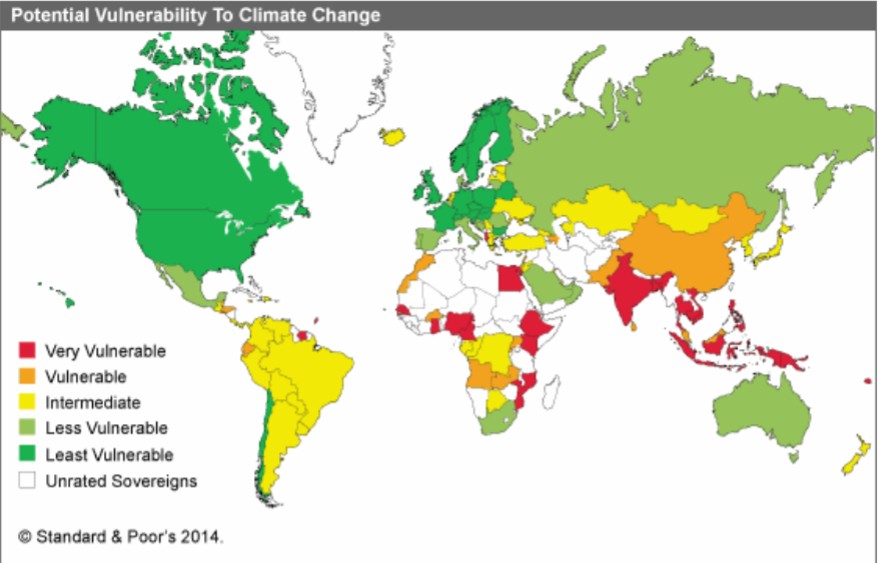

The most vulnerable nations are led by three in South Asia – Cambodia, Vietnam and Bangladesh. Pacific Island, African and South American nations as well appear in the top ten. All of the top 20 are Developing Nations. In contrast, those least vulnerable include Western European nations with Luxembourg, Switzerland, Austria, the Czech and Slovak Republics, Hungary, Slovenia, Germany, and France at the top followed by the United States.

The map below provides a visual reference with nations most and least vulnerable to climate change indicated by various colours. Those in red and orange will be most impacted, while those in shades of green are least vulnerable. The blanks on the map are a result of Insufficient data.

For those nations depicted here as most vulnerable, it means the risk to them is such that their S&P rating is lowered. How does that impact a nation?

If you are not familiar with S&P ratings they follow a scale beginning at the top with a AAA for those most creditworthy, then AA, A, BBB, BB and B for those least creditworthy. Of the nations presented in this latest S&P report only 18 get a rating of AAA while 84 are rated B. That’s because S&P believes any vulnerable nation will be stretched to the limit of its ability to invest in mitigation strategies. And for those who already are struggling because of high deficits and poor economic performance, if not already rated a B, they are certainly destined to reach that credit-rating low.