November 3, 2016 – In five more days America votes. In the state of Washington there is a proposition Initiative 732 or I-732 for short. It is a vote on whether to implement a price on carbon pollution statewide. The tax on carbon will cover the carbon content of imported energy and in-state fossil fuel consumption. A tax on farm diesel will be phased in over a 40 year period. And sequestered carbon is exempted.

The tax on carbon pollution would start at $15 per ton ins 2017, grow to $25 in 2018 and thereafter rise over several decades to $100. At $25 the price of gasoline would go up about 25 cents per gallon and coal-fired power by 2.5 cents per kilowatt hour.

Power generated within the state is largely hydroelectric-generated and therefore would not be subject to a carbon tax.

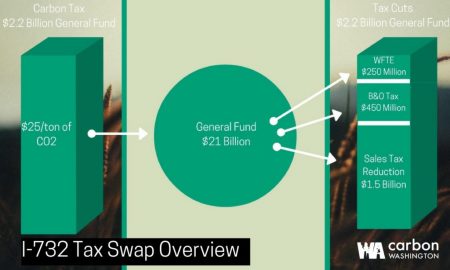

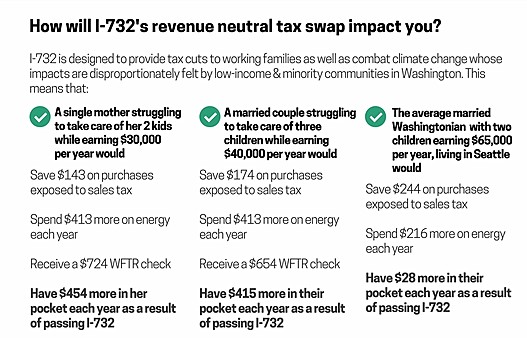

The proponents of I-732 emphasize that they are not advocating a tax increase. It is meant to be revenue neutral with reductions on other existing state taxes. Sales tax would drop by 1%. Business and occupation tax on manufacturers would drop to 0.001%. Low-income families would receive rebates to offset the higher cost of energy as a percentage of income.

The infographic below explains the revenue neutral aspects of the proposition.

Does the initiative have a chance to get passed. Recent polls show 42% support with 37% opposed and 32% undecided. The governor and many state lawmakers are opposed as are the utility and fossil fuel companies. The state chapter of the Audubon Society, academics and climate scientists back the proposal. The Sierra Club and Washington Environmental Council believe in its aims but feel it falls short because there is no reference to direct investment in renewable energy, mass transit and other green projects.

The total value of the tax swap provisions equals $1.7 billion annually or 10% of the the total tax revenue generated by the state annually. Taxpayers will save $1.3 billion in state sales tax. If I-732 is passed Washington state will have created the most progressive carbon tax policy in the United States.